Under the terms of the agreement, Mandarin Oriental will assume management of the Old Cataract Aswan starting this May. The property will then close for a comprehensive upgrade, with a scheduled reopening as the Mandarin Oriental Old Cataract Aswan in July 2027.

Similarly, the Winter Palace Luxor will undergo a full-scale

redevelopment. It is also expected to welcome guests back as the Mandarin

Oriental Winter Palace Luxor in July 2027.

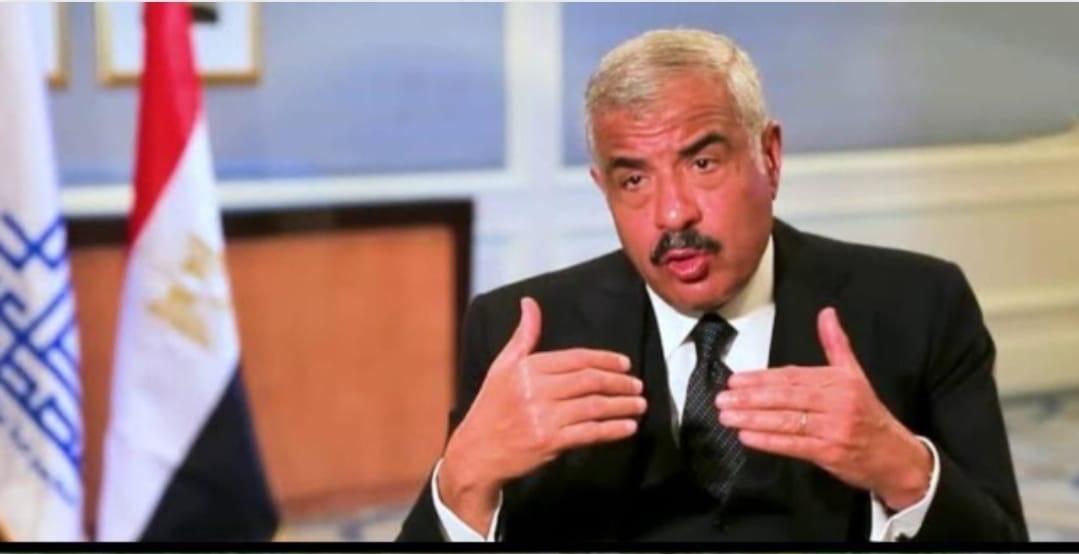

"We are pleased to collaborate with Mandarin Oriental

to manage these iconic historic hotels in Luxor and Aswan," said Hisham

Talaat Moustafa, CEO of TMG Holding, commenting on the partnership.

"These assets represent a core part of the historic

hotel portfolio we recently acquired, which has significantly expanded and

strengthened our hospitality ecosystem," Moustafa added.

"We are working to develop these heritage properties

into world-class luxury destinations and reinforce our position as a leading

hospitality platform in Egypt by combining Mandarin Oriental’s service

standards with TMG’s long-term investment vision and local expertise."

The partnership follows TMG’s landmark 2024 acquisition of a

historic portfolio comprising seven premier hotels. This move significantly

diversified the Group’s presence across Egypt’s most vital tourism hubs,

including Cairo, Alexandria, Luxor, Aswan, and Sharm El-Sheikh.

These historic properties complement TMG’s existing high-end

portfolio, which includes the Four Seasons in Cairo, Alexandria, and Sharm

El-Sheikh, as well as the Kempinski Nile Hotel in Cairo.

TMG is also expanding its hospitality footprint through

several major projects currently under construction. These include the Four

Seasons Luxor, Four Seasons Madinaty, a luxury resort in Marsa Alam, and a Four

Seasons adjacent to the Grand Egyptian Museum.

Upon completion, the group’s total capacity is expected to

reach approximately 5,000 rooms and suites, up from the current 3,500. This

expansion is aimed at bolstering TMG’s position as a regional luxury

hospitality leader while growing its foreign currency-denominated recurring

revenue.

Hospitality and recurring income streams now account for an increasing share of the group’s revenue, contributing more than half of its consolidated EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), underscoring a strategic pivot toward sustainable, long-term profitability.