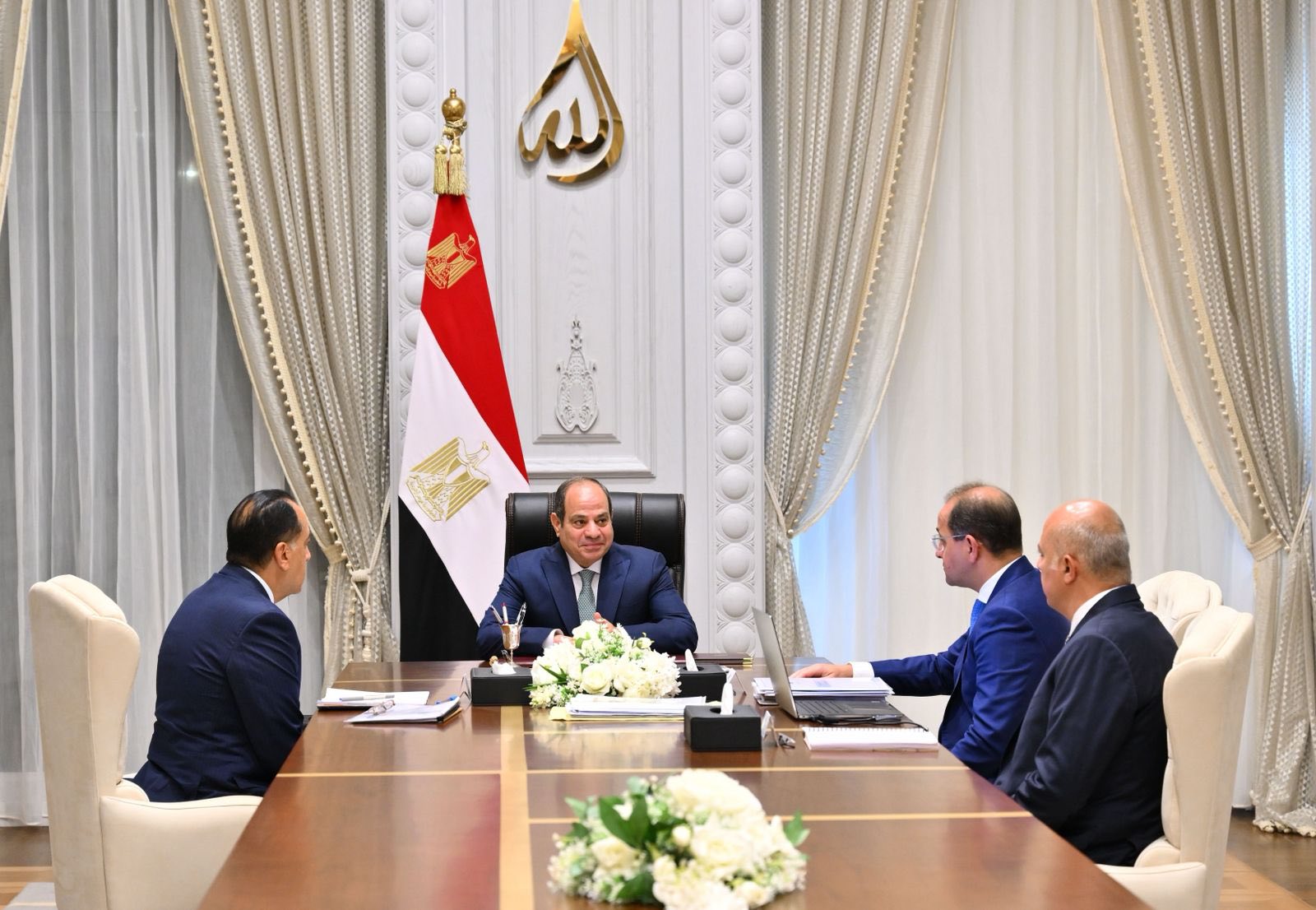

Presidential spokesperson Ambassador Mohamed El-Shenawy stated that the discussions addressed increased volatility in international markets and the impact of geopolitical events, particularly the Iran-Israel conflict, which has heightened uncertainty in key global markets, affecting shipping costs and commodity prices.

The President was also briefed on the results of monitoring

the utilization of the first tax relief initiative up to June 19th. The

Minister of Finance noted that the total number of voluntary tax dispute

settlement requests submitted over the past months reached 110,000. He added

that the number of amended or new tax declarations submitted by taxpayers

exceeded 450,000, reflecting taxpayers' confidence in and positive engagement

with the tax relief initiative.

These new and amended declarations included additional taxes

declared amounting to EGP 54.76 billion. Additionally, 52,901 taxpayers have

applied for tax incentives and facilities for projects with annual turnovers

not exceeding 20 million pounds, under Law No. 6 of 2025.

The Finance Ministry's plans for international issuances for

the 2024-2025 fiscal year were also discussed, with initial indicators

suggesting success in reducing the budget's external debt by $1 billion to $2

billion annually, consistent with government directives.

A review of the financial performance from July 2024 to May

2025 revealed a significant primary surplus and a reduction in the overall

deficit ratio. Tax revenues saw strong and accelerated growth of 36%,

attributed to improved economic activity and an expanded tax base without new

financial burdens, alongside ongoing efforts to rationalize expenditures.

Future targets for the 2024-2025 fiscal year, including the

public budget's debt-to-GDP ratio, tax revenue evolution, growth rates, and

expenditures on wages, goods, services, and interest, were also outlined. The

development of government investments for the fiscal year was also reviewed.

Finance Minister Kouchouk updated the president on efforts

to implement International Monetary Fund (IMF) program reforms and ongoing

negotiations for the disbursement of the fifth review tranche.

El-Sisi instructed officials to leverage international best practices to stabilize financial and tax policies, aiming to improve the business climate, broaden the tax base, attract more investments, boost production and exports, and increase employment. He also called for continued intensive efforts to enhance financial discipline through government measures, fostering economic development and strengthening allocations for social protection, human development, and priority support programs.