This move follows the rapid growth of inDrive's delivery services, which completed over 41 million deliveries globally in 2024, with more than 14 million in the second quarter of 2025 alone. This makes it one of the fastest-growing sectors in the company's portfolio. Building on this momentum, inDrive is expanding beyond mobility into multiple sectors, using delivery and grocery services as key drivers and effective cross-selling mechanisms within its ecosystem.

inDrive's strategy is built on a

confident growth trajectory despite global market challenges. The company has

so far executed over 6.5 billion transactions and has surpassed 360 million app

downloads worldwide. The company's capital-efficient model, low customer

acquisition costs, and high retention rates have already enabled it to achieve

profitability at the EBITDA level while continuing to record double-digit

growth in the first half of this year.

Tailored for Emerging Markets

What sets inDrive apart is that

it was designed specifically for emerging markets, where the growth model is

entirely different from that of traditional global players. These markets are

characterized by fast-changing consumer behaviors, high reliance on mobile

phones, and a growing demand for affordable and fair services. In this context,

groceries stand out as a service that meets daily needs, drives frequent

interaction, enhances loyalty, and opens the door for expansion into additional

services in mobility, delivery, financial services, and more.

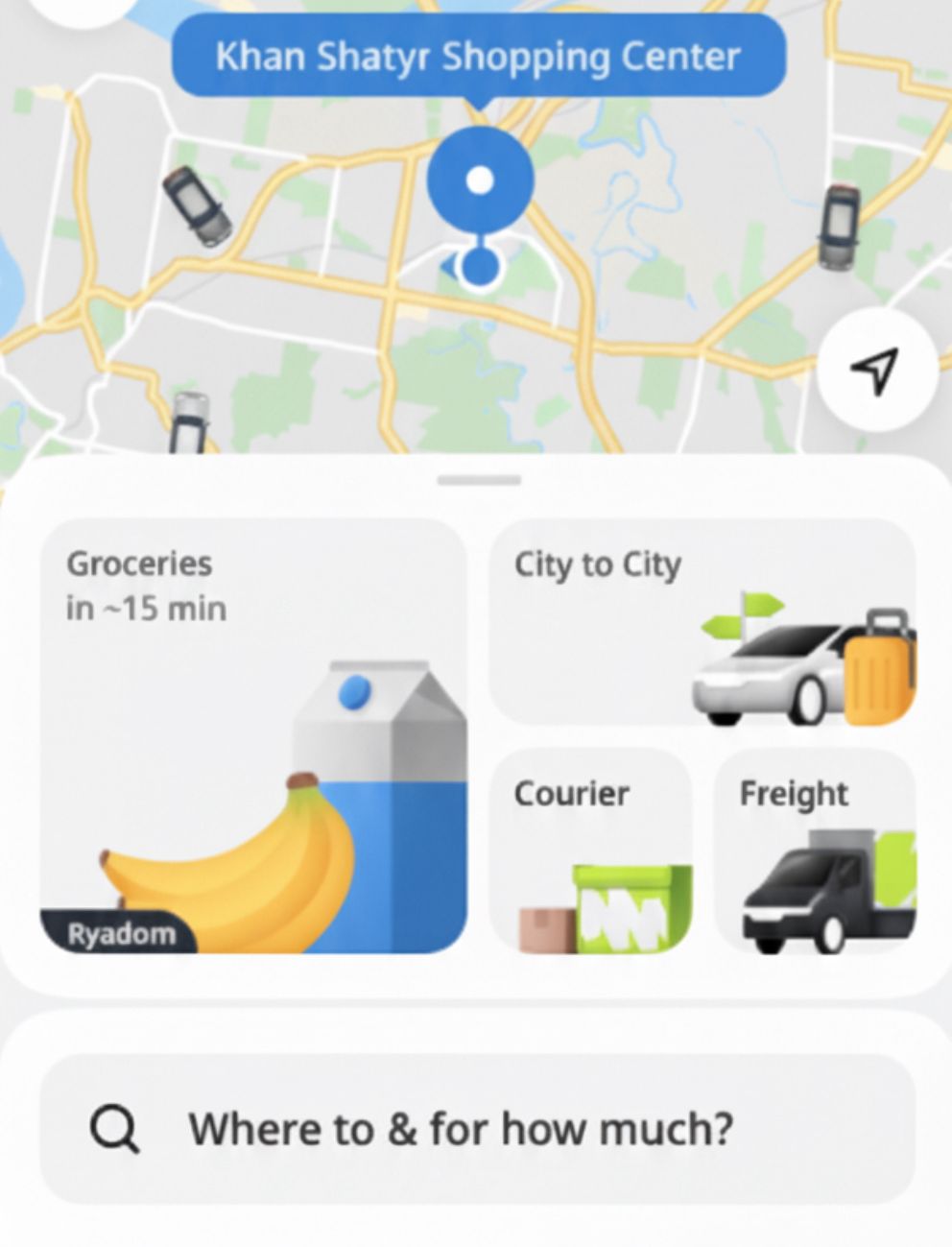

At the core of this new launch is

inDrive.Groceries, which allows users to order over 5,000 products with

delivery in as little as 15 minutes. Initial trials have shown remarkable

results, with the service recording a Net Promoter Score (NPS) of 83% and an

average of five grocery orders per user per month. This clearly shows that

high-frequency grocery services can be a key driver for enhancing daily

engagement and increasing user loyalty across the entire platform.

The inDrive SuperApp features a

flexible, modular design, allowing it to adapt to the specific needs of each

market rather than adopting a one-size-fits-all model. While grocery services

are leading the launch in Kazakhstan, other markets are seeing growth driven by

different sectors. Recently, inDrive expanded its inDrive.Money service in

Brazil, giving drivers and couriers access to digital loans of up to 2,400

Brazilian reals. Similar services have already proven successful in markets

like Mexico, Colombia, and Peru. This flexible approach ensures the delivery of

services most relevant to local communities, whether they are digital loans,

food delivery, shipping, or light mobility solutions.

The initial results of the

inDrive SuperApp launch indicate the significant potential of this model. Data

from a sample of 16 major cities showed that users who use more than one

service generate a two- to four-fold higher Gross Merchandise Value (GMV) and

have a retention rate more than 15 percentage points higher compared to users

who only use a single service.

Over the next twelve months,

inDrive plans to launch its SuperApp in several key emerging economies,

including Kazakhstan, Mexico, Colombia, Peru, Pakistan, and Egypt, which is a

priority country for the company and one of the next countries where the

inDrive SuperApp will be launched. Other target markets include Brazil and

Morocco. Each new launch is based not only on the strength of the local

presence but also on the strong network effects of the inDrive platform. This

foundation allows the company to expand at a faster pace with lower acquisition

costs, creating a tangible impact in markets where traditional SuperApp models

have struggled to gain traction.

Unlike traditional SuperApps that

emerged before the age of AI, inDrive is integrating AI capabilities from the

start, while always adhering to its core principles of fairness and user

freedom of choice. Personalization technologies facilitate users' seamless

movement between services, while digital inclusion features allow people with

disabilities or limited literacy to access services. Furthermore, AI

recommendations are designed to be a guide, not a decision-maker, ensuring that

the direct negotiation mechanism between individuals remains at the heart of

the platform's pricing model.

Andres Smet, inDrive's CEO of

Business Growth, stated: "Grocery services are the high-frequency pillar

that brings users back to the platform daily, and the initial results show the

significant potential that exists when customers find more connection points.

What distinguishes our model is that we don't introduce all services everywhere

at once; instead, we offer what meets the needs of each city individually,

while adhering to our firm principles of fairness, transparency, and freedom of

choice. This is precisely what makes our SuperApp strategy scalable and

sustainable."

With eight active sectors already within its ecosystem, inDrive is laying the foundation for a SuperApp designed not for saturated global markets but for emerging economies where providing fair access to services can make a fundamental difference.