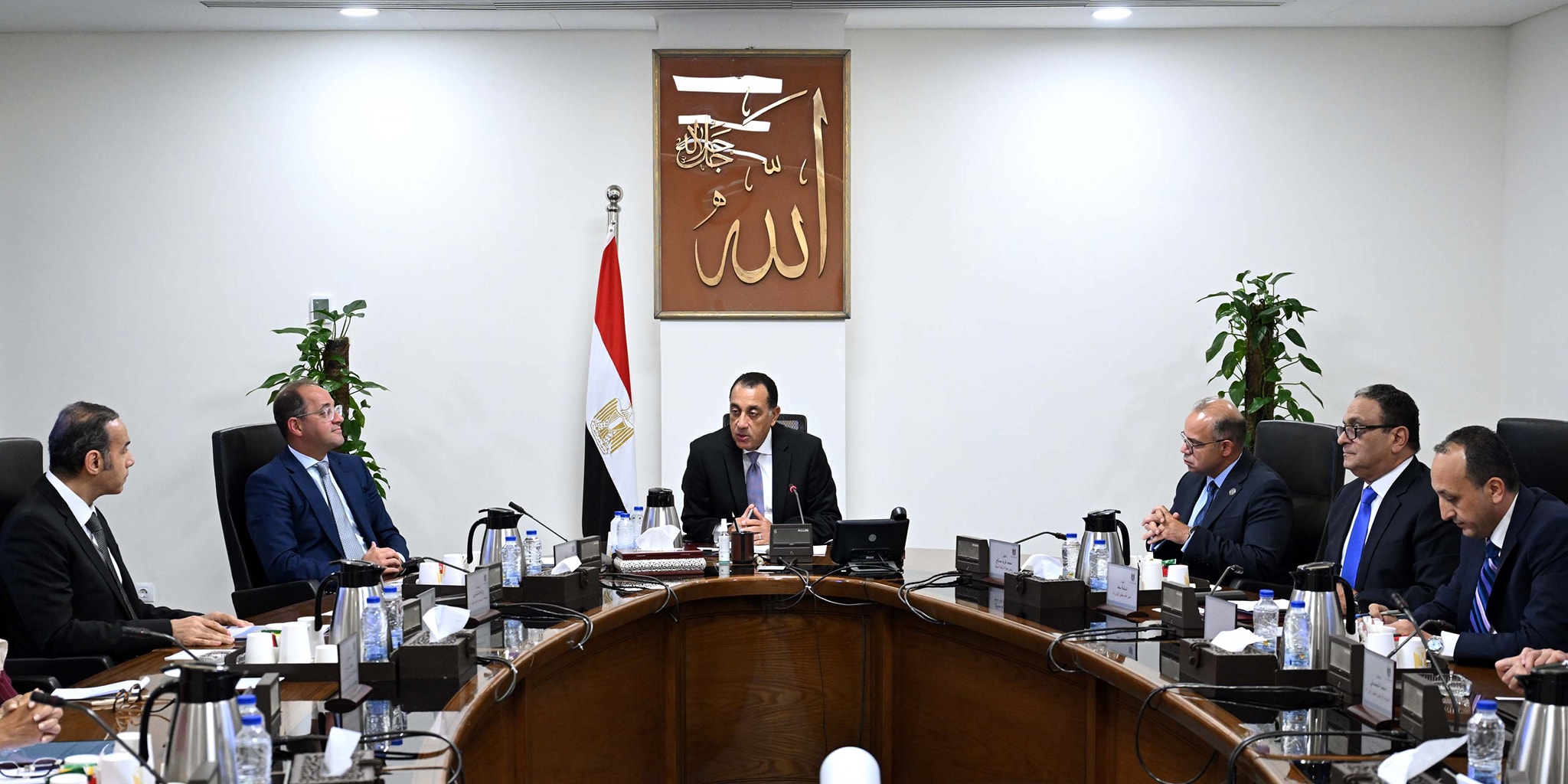

Madbouly reaffirmed the government’s full support for

efforts to develop Egypt’s capital market, describing it as one of the main

tools for achieving economic growth targets, boosting investment rates, and

enhancing private sector participation in economic activity.

Farid stressed the continued close coordination between the

Authority and the EGX to ensure market stability and strengthen its role in

financing companies and providing diversified investment solutions, positively

reflecting on the national economy. He added that the FRA is moving towards

activating and expanding new financial and investment instruments to enhance

efficiency and competitiveness, while keeping its primary focus on maintaining

the stability of markets and non-banking financial institutions and

safeguarding the rights of all participants. He also highlighted that financial

technology and sustainability are key pillars for reinforcing the role of the

non-banking financial sector in supporting the national economy.

Azzam explained that the stock exchange will advance along

two parallel tracks in the coming period: deepening the market and broadening

its instruments by introducing new financial products such as derivatives, and

activating the market-making mechanism to create greater opportunities for

investors and strengthen efficiency and competitiveness. He stressed that

trading activity will remain fully governed by supply and demand, adding that

the EGX administration is committed to maintaining ongoing dialogue with

stakeholders to shape more effective policies that boost competitiveness and

market attractiveness.

Kouchouk noted that incentives for large-scale offerings on

the EGX are under study to encourage companies to list, offer, and trade their

shares, thereby enhancing market depth and activity while reflecting the

state’s commitment to expanding ownership and attracting more domestic and

foreign investments.

He added that, in coordination with the FRA, the ministry is

also working to support the government’s plans to increase private sector

participation by intensifying promotion efforts and attracting new offerings

from both private and state-owned companies, which would help increase

liquidity and diversify the investor base.