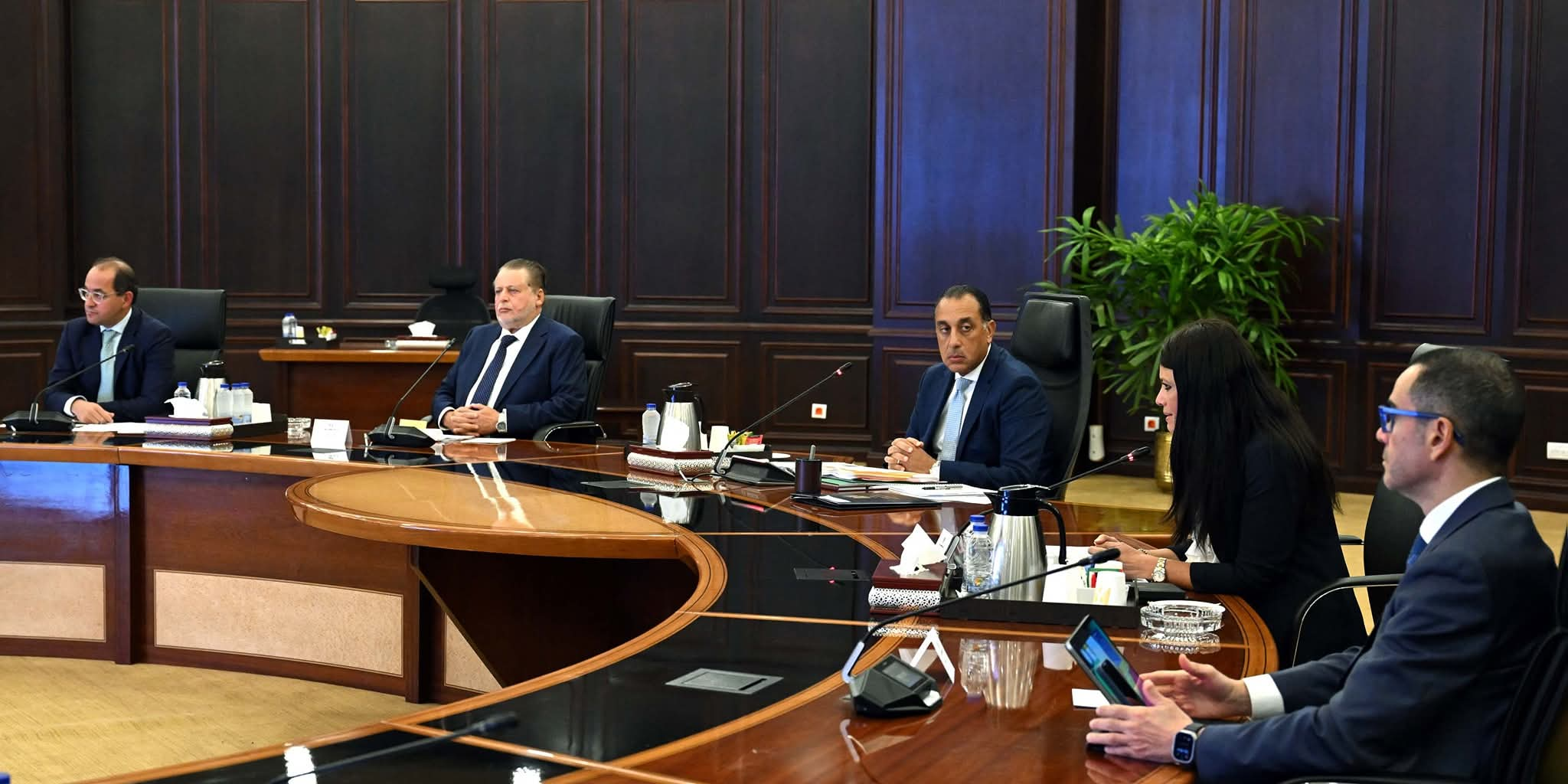

The meeting was attended by Central Bank Governor Hassan Abdalla, Minister of Planning and Economic Development and International Cooperation Rania Al-Mashat, Finance Minister Ahmed Kouchouk, Minister of Investment and Foreign Trade Hassan El-Khatib, and other senior officials and experts.

Cabinet spokesperson Mohamed El Homossany stated that the

council affirmed the ongoing commitment to a flexible exchange rate system and

the implementation of the government's privatization program, as outlined in

the "State Ownership Policy Document." These measures aim to generate

additional resources to reduce budget debt. The council also underscored the

continued efforts of the Competition Protection Agency to safeguard market

competitiveness.

He added that the government is successfully proceeding with

its plan to repay dues to foreign partners in the petroleum sector, adhering to

the established timeline.

The meeting also reviewed key policies and measures under

the National Structural Reforms Program, which serves as the primary tool for

translating economic objectives into tangible results. This program focuses on

three pillars: enhancing macroeconomic stability, increasing economic

competitiveness and improving the business environment, and supporting the

green transition.

El Homossany noted that the Ministry of Planning has, for

the first time, set a clear timetable for all policies and procedures included

in the national economic development narrative. Their implementation and

progress will be monitored quarterly through an integrated platform developed

by the ministry to support good governance.

Discussions also covered the outcomes of the Fourth United

Nations International Conference on Financing for Development in Seville,

Spain. Egypt's key messages at the conference included promoting the private

sector, boosting foreign investment in developing countries, improving

governance in international financial institutions, increasing developing

countries' Special Drawing Rights allocations, and strengthening the UN's role

in global economic activities. The importance of updating debt sustainability analysis

methodologies, enhancing South-South and triangular cooperation, establishing a

unified concept of global public goods, and utilizing innovative financing

mechanisms to support small and medium-sized enterprises and entrepreneurship

were also highlighted.

Furthermore, the meeting reviewed the structure of total

investments for the 2025-2026 fiscal year, with an emphasis on achieving public

investment governance targets while expanding private sector activity.

The council also examined the external debt situation from

March 2024 to March 2025, confirming that the external debt-to-GDP ratio

remains at safe levels.

Finally, El Homossany stated that the meeting addressed the plan to cover financial needs and obligations for the current 2025-2026 fiscal year, noting a comprehensive plan with specific timings for covering dollar resource requirements. He added that Egyptian bonds in international markets are performing well, with declining yields and reduced risk insurance rates due to the stability of the Egyptian economy and strong investor interest.